WHAT’S INSOLVENCY?

The term « insolvency » is widely used, especially in these troubled economic times, but what does it mean exactly? Insolvency is a state of financial distress where an entity’s liabilities exceed its assets, making it difficult or impossible to meet its financial commitments.

In the last few months, Belgian insolvency law has come to the forefront of the news, with the recent transposition of the Directive 2019/1023 on Restructuring and Insolvency into Belgian law. This long-awaited Law of 7 June 2023 – entered into force on 1st September 2023 – brings its share of novelties to the Belgian insolvency landscape.

This is an opportunity to take stock of the main principles of Belgian insolvency law, and to highlight some fundamentals and novelties that any business should know to deal confidently with the insolvency issues it may face.

Indeed, insolvency is likely to be a central topic for any business, whether it be for the debtor undertaking fearing that its continuity may be put at risk, or for its creditors, who need to manage the consequences of the debtor’s insolvency.

WHAT TO EXPECT FROM THIS INSOLVENCY SERIES?

Understanding insolvency and seeking professional advice when facing insolvency as a debtor or as the creditor of an undertaking in financial difficulties is crucial to making informed decisions about how to address and potentially resolve the situation.

Our insolvency series aim at providing a practical overview of the existing insolvency procedures and pre-insolvency measures, each time examining the debtor’s point of view and the creditor’s perspective.

Subjects to be covered are:

- Identifying risks of insolvency and pre-insolvency tools to avoid insolvency (episode 2)

- In and out of court reorganisation proceedings (including new confidential procedures) (episode 3)

- Liquidation/bankruptcy proceedings (episode 4)

- International aspects of insolvency proceedings (episode 5)

In this first episode, we will introduce the topic with some general background information on Belgian insolvency law.

WHAT COVERS BELGIAN “INSOLVENCY LAW”?

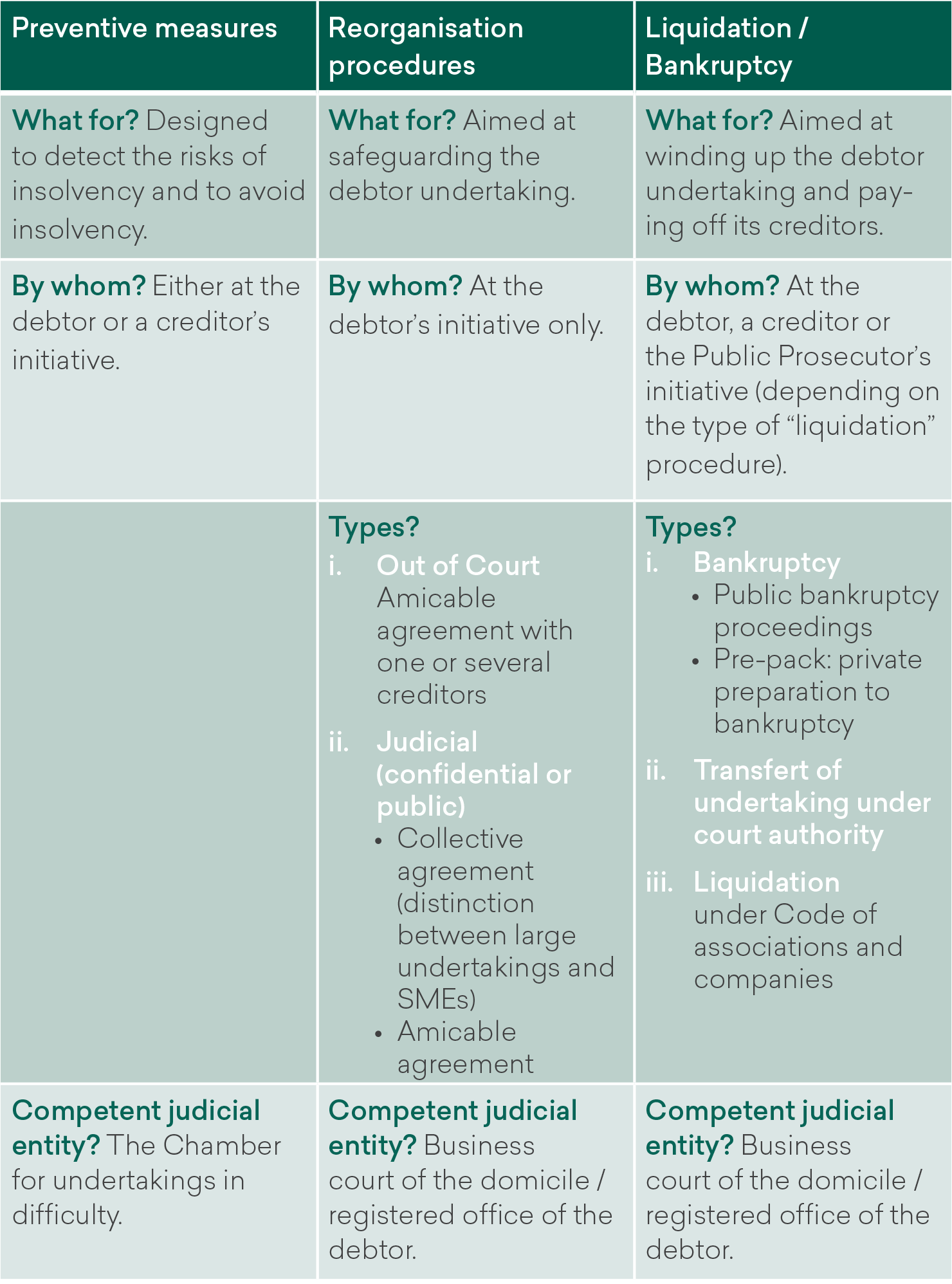

Belgian insolvency law is regulated by Book XX of the Belgian Code of economic law (“CEL”). It encompasses three “pillars”, which serve different purposes:

WHO IS SUBJECT TO INSOLVENCY PROCEEDINGS?

Insolvency law has a wide scope of application.

Any undertaking may be subject to insolvency proceedings. In a nutshell, it encompasses:

- all legal entities with legal personality[1] (including non-profit organisations), except public legal entities such as the Belgian state, communities and regions, municipalities and provinces, as well as legal entities governed by public law;

- self-employed natural persons engaging in a professional activity (e.g. liberal professions);

- organisations without legal personality distributing profits to their members or aiming at such a distribution of profits.

[1] It is to be noted that regulated companies in the financial and insurance sectors are bound by specific insolvency procedures.

HOW WIDESPREAD ARE INSOLVENCY PROCEEDINGS IN BELGIUM?

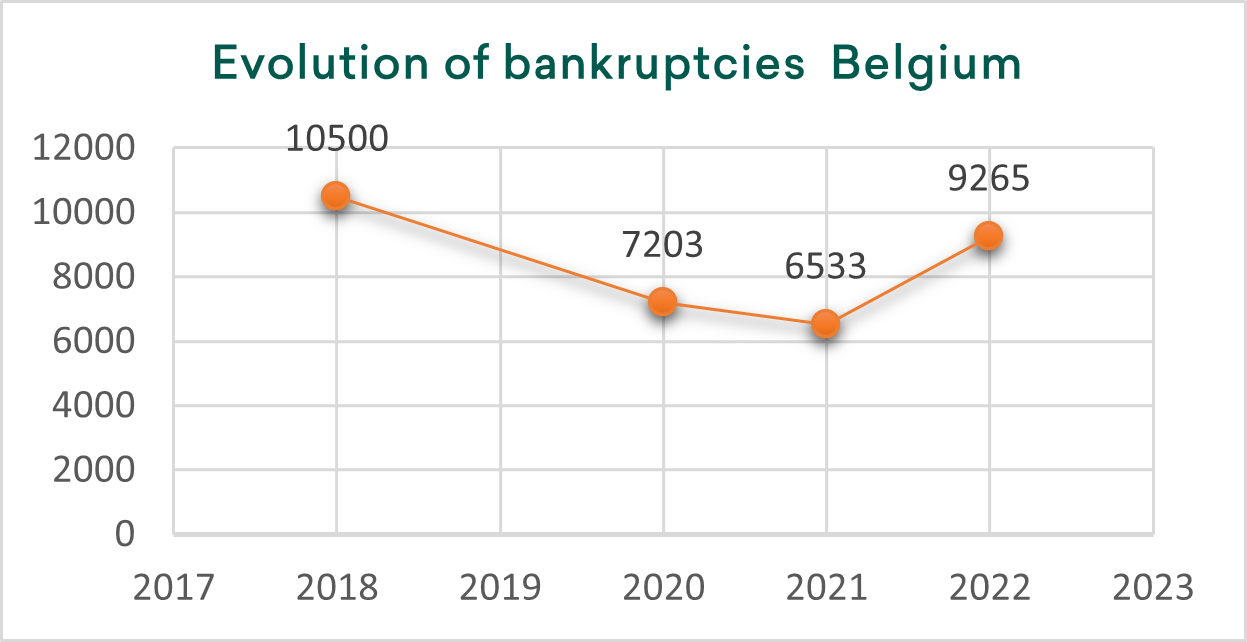

Bankruptcy

There was a clear drop in bankruptcies during the Covid-19 crisis, notably due to the successive “moratoria” imposed by the Belgian government on bankruptcy proceedings. If we haven’t returned to pre-Covid levels, the number of bankrupties started to rise again in 2022:

Source Statbel link

Judicial reorganisation

It is more difficult to have a complete picture of the number of judicial reorganisations recorded in Belgium, as there are quite surprisingly no published statistics in this respect. Nevertheless, according to some available figures, one can observe that judicial reorganisation procedures are less frequent than bankruptcies. It also appears that judicial reorganisations by collective agreement are more frequent than judicial reorganisations by amicable agreement. As for the “confidential” reorganisation proceedings introduced during the Covid-19 crisis, it has almost never been used. Let’s keep a close eye on the figures for these confidential procedures, which are now officially « confirmed » with a few adjustments in the Law of 7 June 2023.

STAY TUNED

These figures and data’s show us that insolvency is and remains a hot topic, particularly during the economically troubled times we are going through.

You want to learn more about insolvency issues, whether you are an undertaking currently facing financial difficulties, or a creditor wishing to protect itself against the risk of insolvency of its debtors, or to know more about the impact of such insolvency, stay tuned for the next episodes of this “fascinating” insolvency series.

Download PDF version here

For any questions or assistance, please contact Fanny Laune.

***

This article is not a legal advice or opinion. You should seek advice from a legal counsel of your choice before acting upon any of the information in this article.