Deferred payment methods, often called “Buy Now Pay Later (“BNPL”) solutions”, allow customers to acquire goods immediately while spreading the payment of the purchase price over time. The interest for consumers is obvious and consists in softening the impact of a purchase on one’s finances. For merchants, the solution is also advantageous. It allows them to reach a broader customer base by offering more flexibility and choice in the way their clients can pay for their goods.

BNPL methods have been on the rise over the last few years. Swedish Klarna (currently valued at approximately EUR 9 billion) is the absolute European champion. However, it starts feeling the heat from numerous FinTech start-ups and incumbent credit providers which also begin to look into this lucrative business. CB Insights reported that 2020 was an absolute record funding year for the BNPL sector, with over EUR 1.24 billion raised globally.

Credits in disguise

The pandemic has given a huge boost to online shopping. Growing parts of the population who suffer from the financial crisis warmly welcome BNPL options. At the same time, politicians and a part of the public opinion criticise these solutions as they tend to incite consumers into purchasing more goods than they can actually afford. Indeed, the BNPL approach largely disconnects the purchase commitment from the payment of the price.

Deferred payment methods are often presented as ordinary payment methods on web shops’ check-out pages and are listed along well-known direct debit methods and payment applications. However, in practice, BNPL solutions often qualify as (consumer) credit products, at least under European / Belgian law.

Different setups same outcome

Several setups exist in the deferred payment space. Although these models seem different from the outside, most of them boil down to a credit provision from a regulatory standpoint. In this article, we focus on two business models which are recurrent in the market and have contrasting approaches.

The BNPL provider as a lender

How does it work?

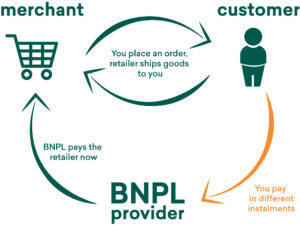

In the most classic deferred payment model, the BNPL provider acts as a lender. It immediately pays the merchant on behalf of the customer and the customer reimburses the purchase price to the BNPL provider in several instalments. In many cases, the recurrent instalment payments are charged to the customer’s existing debit or credit card. The fact that customers can use their existing means of payment or credit card adds to the general attractiveness and simplicity of the BNPL solution.

Beware of the consumer credit regulation

Consumer credits in Belgium (and across the EU) are among the most heavily regulated financial products. Without going into details, regulated consumer credit providers need to:

- apply for a dedicated licence with the Financial Services and Markets Authority (FSMA),

- comply with various rules of conduct (including all sorts of information obligations), and

- have their template credit contracts pre-approved by the Federal Public Service Economy (FPS Economy).

In practice, many BNPL providers try to remain outside the scope of regulated consumer credits and explore the (limited) exemption regimes.

What are the possible exemptions?

In Belgium, as elsewhere in Europe, the most used exemption is the so-called low-cost credit exemption which allows excluding from the scope of regulated consumer credits all loans (i) without interest, (ii) repayable within a period of maximum two months, and (iii) the cost of which amounts to less than 4.86 EUR / month (indexed amount for 2021). This exclusion is tailor-made for a very common credit card model on the Belgian market whereby cardholders must reimburse the used amounts at the end of the month following their purchases.

Deferred payment solution providers also use this exemption. They allow their customers to pay in three instalments paid over a period of 2 months: one payment at the time of the purchase, a second one after a month, and the final instalment at the end of the second month. The solution provider is mostly remunerated by the merchant who accepts to be paid (a bit) less than the amount reimbursed by the customer.

All other BNPL solutions – whereby customers are allowed to spread the reimbursement further in time or whereby an interest is charged – normally qualify as a regulated consumer credit as per the CEL, placing a heavy regulatory burden on the deferred payments provider as set out above.

The BNPL provider as a technical gateway / The merchant as a lender

Not all BNPL providers act as creditors advancing the full amount of the purchase (and/or acquiring the receivable from the merchant) and granting a loan to the customer. Certain BNPL providers simply act as intermediaries between the merchant and the customer who agree on the payment terms of the merchant’s goods.

At the moment of the purchase, only the first instalment is charged to the customer’s credit card. The BNPL provider then requests an authorisation, on behalf of the merchant, from the customer’s credit card company to reserve the remaining amount on the customer’s available credit line. Each month, the customer’s credit card is charged according to the instalment plan agreed upon between the client and the merchant at the time of the purchase. After each payment, the BNPL provider issues a new authorisation on behalf of the retailer, reserving the outstanding part of the price (purchase price less any instalments paid over time).

In this setup, the BNPL provider merely acts as a technical gateway ensuring the exchange of messages (the matchmaking of payment authorisations and payment requests). Funds never transit through the BNPL provider. When opting for such services, the merchants receive their (split) payments directly through the card scheme used by the customer. The merchant is not paid in full at the moment of the purchase, but simultaneously with the monthly instalments paid by the customer.

Such solutions often combine the technical gateway function with the granting of an access to a platform where both the customer and the merchant can keep track of their past and current instalment plans and even communicate with each other. From a legal perspective, these platforms are more of a technical service than a regulated activity.

However, such technical gateway solutions are not fully unregulated. The BNPL providers usually do not fall into regulated (credit) activities, but the overall outcome of this setup still qualifies as a deferred payment in practice and, hence, as a (regulated) consumer credit from a legal perspective.

The notion of consumer credit is indeed very broadly defined as “a credit which, regardless of its name or form, is being granted to a consumer and which does not qualify as a mortgage credit” (Article I.9, 54°, CEL).

This definition shows that a consumer credit can take very different forms and names, and still fall within the scope of Book VII of the CEL on regulated consumer credits. One cannot exclude the application of consumer credit rules merely because no interest is requested from the lender or none to very little costs are charged.

The merchant enters into a direct relationship with the customer which has the right to pay the purchase price in different (monthly) instalments. A practical consequence could be that the transaction qualifies as a “sale on instalment credit terms” (“vente à temperament”/”verkoop op afbetaling”) and that merchants working with such (unregulated) “technical gateway” BNPL solutions, fall themselves within the consumer credit regulation. Hence, they should have a licence and act as regulated consumer credit providers. This problem is often observed in practice with foreign non-EU BNPL providers with a different regulatory background where this setup has not the same (unpleasant) consequences for the merchants.

BNPL in the future

The analysis above shows that both BNPL providers and merchants should be careful when setting up deferred payment solutions. Options that are perfectly viable for all parties in one country may trigger different regulatory consequences in another. One of the key issues is clearly the lack of a fully harmonised EU framework.

Regardless, the interest in BNPL solutions is growing, new players are coming into Europe from Asia, Australia and the Americas, and new business models are mushrooming all over the world. Combined with the existing credit regulation and some criticism over these models, we are looking forward to seeing how this interesting niche will develop from a regulatory and business perspective.

***

Our team has vast experience in representing several BNPL providers from all continents to roll out their services in Belgium and Europe.

For any question or assistance regarding BNPL solutions, please contact our Digital Finance Team: digitalfinance@simontbraun.eu – +32 (0)2 543 70 80

This article is not legal advice or opinion. You should seek advice from a legal counsel of your choice before acting upon any of the information in this article.