IDENTIFYING RISKS OF INSOLVENCY AND PREVENTIVE TOOLS TO AVOID INSOLVENCY

Insolvency proceedings, and in particular liquidation proceedings, should remain a last resort.

Accordingly, the Belgian Code of Economic Law (“CEL”) contains several preventive mechanisms designed (1) to detect the risk of insolvency in due course, and (2) to take preventive measures to redress undertakings’ financial situation, ideally at lower cost and with consideration for creditors’ rights.

At least one Chamber for Undertakings in Difficulty (“CUD“) is established within each Business court, and is given authority to implement such measures. The recent law of 7 June 2023 transposing the Directive 2019/1023 has further extended the powers of these CUDs.

Detection and prevention mechanisms are in the interest of both the debtor and its creditors. Nevertheless, the creditors’ role is rather limited, as the CUD mainly operates confidentially. However, the law of 7 June 2023 opens a new possibility for involving creditors in discussions before this CUD. In addition, creditors can benefit from a degree of protection against their debtor’s insolvency through contractual mechanisms (see below).

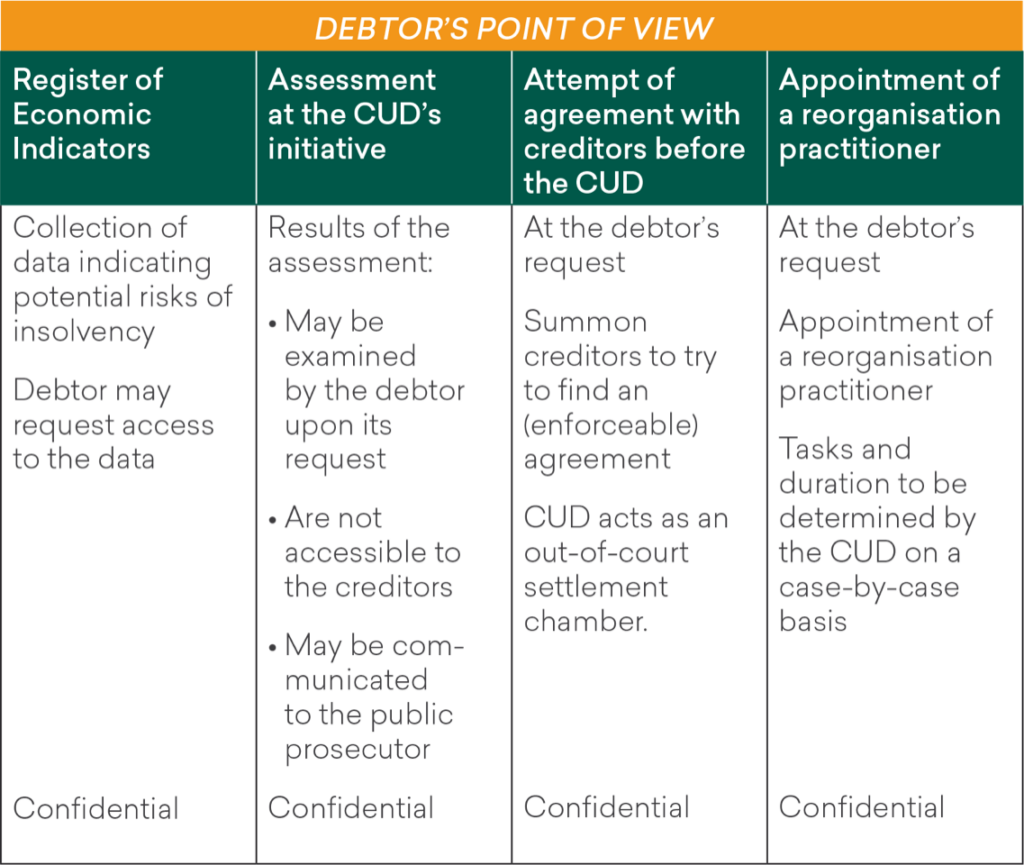

PREVENTIVE TOOLS FROM THE DEBTOR’S POINT OF VIEW

Identifying risks of insolvency

The CUD may identify risks of insolvency by using the “central register of economic indicators for the detection of undertakings in financial difficulty” (the “Register of Economic Indicators”). This tool centralises various data regarding undertakings, which may be indicative of a risk of insolvency (for instance, whether the debtor has outstanding public debts, whether it has been subject to seizures, …)

Access to the Register of Economic Indicators is strictly limited to the CUD’s judges and clerk’s offices. Creditors or other interested third parties may not consult it.

However, the law of 7 June 2023 now authorises debtors to request access to the data concerning them. The Register of Economic Indicators has thus also become a self-assessment tool available to the debtor.

Assessment of the debtor’s situation at the CUD’s own initiative

Based on the data contained in the Register of Economic Indicators, the CUD may, at its own initiative, initiate an assessment of an undertaking’s financial situation, in view of safeguarding the continuity of its business and ensure the protection of its creditors’ rights.

The CUD enjoys extensive powers when conducting such an assessment (for instance, it may summon the debtor, hear third parties, or request additional data to be provided).

The CUD’s findings are not published, but the debtor may request access to these findings.

The undertaking’s creditors will not be informed of the assessment, and will not be allowed to attend the CUD’s hearing either, unless they are invited to do so (see below).

It is also to be mentioned that further to this assessment, the CUD may communicate these findings to the public prosecutor, potentially leading to a bankruptcy petition, or decide to reconvene the debtor for a reassessment at a later stage.

Attempt to reach agreement with the undertaking’s creditors before the CUD

A debtor experiencing financial difficulties and fearing to become insolvent may now – since the law of 7 June 2023 – proactively request to convene its creditors (or some of them) before the CUD to try to find an agreement with the assistance of the latter. Such an agreement may be made enforceable.

Request for appointment of a reorganisation practitioner / Undertaking’s mediation

The debtor may also request the CUD1 to appoint a reorganisation practitioner (previously known as the “undertaking mediator”) to facilitate, on a confidential basis, the reorganisation of the debtor’s business.

The CEL does not specify which tasks are entrusted to this reorganisation practitioner and for how long he or she is appointed. The CUD has a wide margin of appreciation and decides on a case-by-case basis. In any event, the debtor will remain in charge of the management of its business.

This procedure for appointing a reorganisation practitioner is confidential. Hence, the undertaking’s creditors will neither be summoned, nor informed.

1. And no longer the President of the business court (as it was required prior to the entry into force of the law of 7 June 2023).

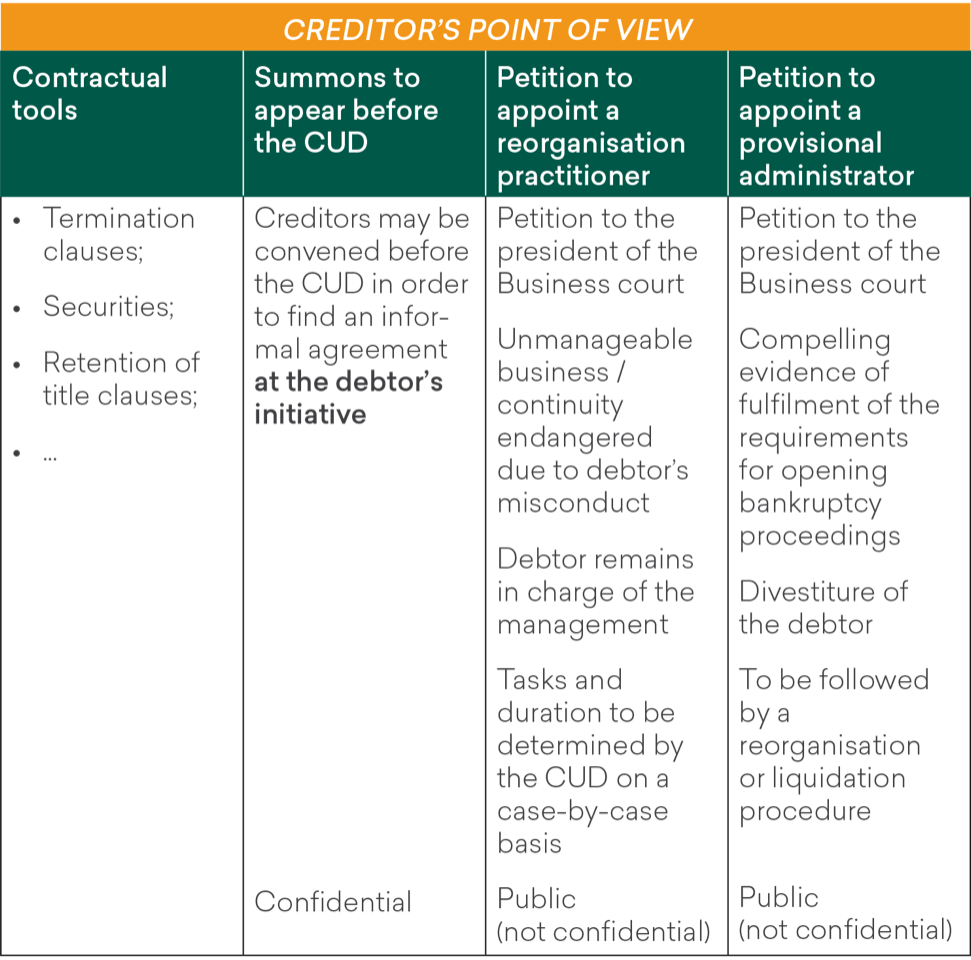

PREVENTIVE TOOLS FROM THE CREDITORS’ POINT OF VIEW

Although the preventive tools provided for in the CEL are ultimately designed to protect creditors’ rights, they do not grant them any significant right of initiative.

This does not mean that creditors are completely deprived of power.

The first and principal means of protection available to creditors against the risk of insolvency of their debtor is negotiating adequate contractual guarantees.

Various possibilities are available, depending on the nature and object of the contract at hand. Among the most used protection mechanisms for creditors, one may list:

- Clauses providing termination of the contract in case of bankruptcy or liquidation of the contracting party. It is to be noted that such express resolutory clause is prohibited in the event of judicial reorganisation of the debtor;

- Securities (e.g., pledge, mortgage, personal guarantee, right of retention, etc.);

- Retention of title clauses;

- …

In addition, a creditor may – in certain circumstances, and when the risk of the debtor’s insolvency is imminent – petition for provisional measures before the president of the Business court.

Such measures – unlike the measures that can be taken by the CUD – will be decided in the context of public proceedings:

- First, when it appears that the debtor’s business has become unmanageable or that the debtor’s continuity is put at risk due to its misconduct, the creditor may request that a reorganisation practitioner be appointed2. The debtor remains in charge of the management of its business;

- Second, provided that there is compelling evidence that the requirements for opening bankruptcy proceedings are fulfilled, creditors may request the appointment of a provisional administrator3. This measure aims at divesting the debtor from the management of its business, and precedes insolvency (reorganisation or liquidation) proceedings.

2. The debtor, the public prosecutor and any interested third party may also formulate such a request.

3. The president of the Business court may also appoint such a provisional administrator on his/her own initiative.

Summary

Stay tuned

Insolvency is and remains a hot topic, particularly during the economically troubled times we are going through.

You want to learn more about insolvency issues, whether you are an undertaking currently facing financial difficulties, or a creditor wishing to protect itself against the risk of insolvency of its debtors, or to know more about the impact of such insolvency, stay tuned for the next episodes of this “fascinating” insolvency series.

Download PDF version here

For any questions or assistance, please contact Fanny Laune.

***

This article is not a legal advice or opinion. You should seek advice from a legal counsel of your choice before acting upon any of the information in this article.